In this report, part one in the series, the detailed analysis results in the following key takeaways:

- Auto dealer groups are still enjoying extraordinary earnings, however, the growth in profits have likely levelled off in Q2/Q3 2022

- Consolidation continues to be a dominant trend in retail automotive and will be for some time as the industry is still very fragmented.

Breakdown of dealership owners

| Number of Dealerships | Percentage of Owners |

| 50+ | 0.8% |

| 26-50 | 0.9% |

| 11-25 | 7.4% |

| 6-10 | 15.4% |

| 1-5 | 75.5% |

| 100.0% |

Source: Pitcher Partners dealer listing

- Average estimated goodwill values for dealerships have doubled since Q4 2019 with the multiples of net profit before tax (NPBT) remaining constant, the uplift in goodwill values attributed to increased profitability

- Pent up demand is driving 2022 volumes and tight supply will underpin dealer profits for some time (at least another 12 months) despite the significant economic headwinds that are emerging.

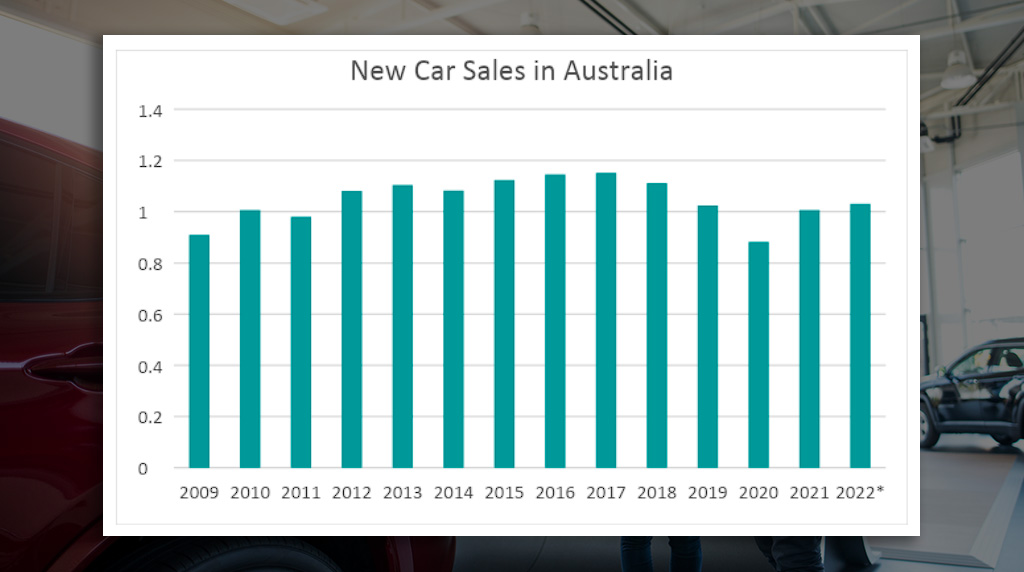

Source: VFacts & *Annualised figures

Economic and new vehicle supply trends – a bit of history

In the past two and a half years (since Q4 2019), we have experienced the following:

2020/2021

- A pandemic with widespread and sometimes brutal lockdowns

- Unprecedented government spending, quantitative easing (money printing) and low interest rates

- Global and regional restrictions on travel and government assistance led to some of the highest savings’ rates in Australia’s history

- A global logistics crisis increasing input costs and limiting supply of parts

- Constricted new vehicle supply due primarily to a microchip shortage

- Holden’s exit from Australia

- Honda and Mercedes-Benz moved to agency sales models

- Increased consumer demand for cars as travel & holiday spending went to zero and the shift from public to personal transport preferences gained traction.

2022

- The cashed-up consumer was let loose, making up for lost time by spending their savings accumulated over previous two years

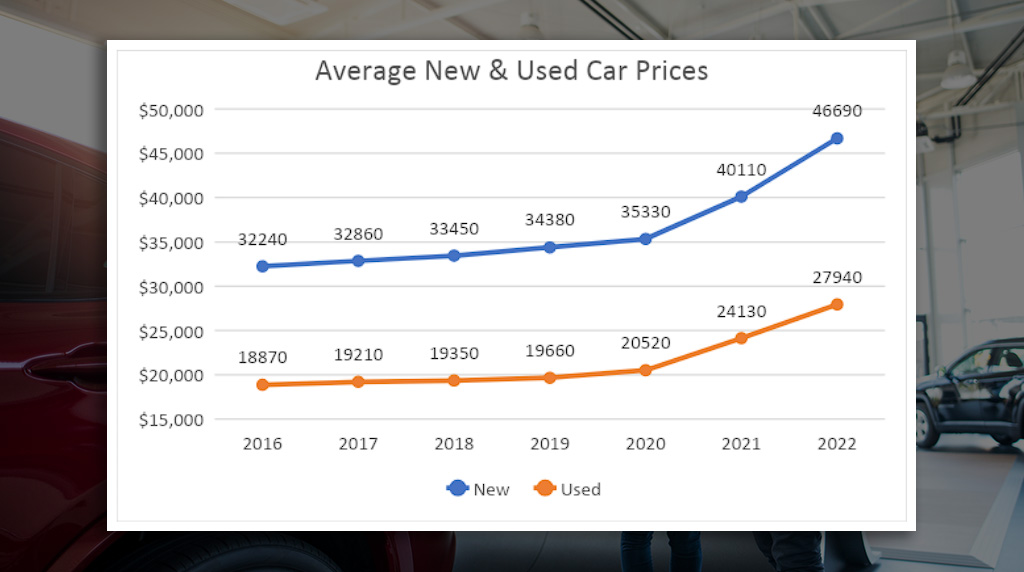

- Supply of new vehicles floundered in comparison to the demand from consumers, leading to inflated used car prices and ever-growing gross margins as the transaction price has increased by ~50%, (refer chart below)

Source: Pitcher Partners Analysis

- Microchip and other component shortages intensified with forecasted supply shortages to last another 12 months

- A war in Ukraine significantly escalating fuel & energy prices

- Rapidly rising inflation (driven by central banks activity and supply constraints) in most economies leading to interest rate raises at a pace not seen for over 40 years to reign it in

- Consumer confidence now in a free-fall

- China threatening war in Taiwan which is now being priced into capital markets

Note: Some of these factors, which would usually have a sharply negative effect on the retail automotive industry, were countered by increased vehicle transaction values and margins that combined to deliver record profits for motor dealerships across Australia.

Next week: Trends on mergers and acquisitions

By Steve Bragg

Read More: Related articles

Read More: Related articles