IN THIS, the fifth in our Management Workshop series for GoAutoNews Premium, the team at the motor industry services group at Pitcher Partners Sydney has identified more key macroeconomic conditions that will provide headwinds for dealers in the next 12 months.

The Dealership – Gross Margins

As previously discussed in the series, Gross Margins are currently inflated on both new and used cars as there is reduced supply.

Gone are the days of losing money on the metal only for the manufacturer bonuses and incentives to make up the majority if not all the gross profit for the month.

But margins are expected to slowly return to pre pandemic levels once production and supply turns around. However, the exact timing of this is uncertain.

A realistic yet unique situation that Australia may face is as a dumping ground for the right-hand drive internal combustion engine (ICE) vehicles from other countries.

With the UK banning ICE vehicles sales from 2030 and the rest of the European Union following suit from 2035, and the lack of clear policy currently, Australia may open itself up for a place to ship all excess stock.

Depending who you are there are both positives and negatives to this situation, however if this were to occur, it would mean returning to stock being stuffed (flooding) into every spare square metre a dealer has, razor thin margins and a reliance on OEM incentives to make gross profits.

Parallel imports are currently banned in Australia unless the vehicle has passed the requirements as a Specialist and Enthusiast Vehicle (SEV).

After significant lobbying,the Australian Government backed down from implementing a parallel import scheme in 2018 despite advice from the Productivity Commission, the Harper Competition inquiry and the Australian Competition and Consumer Commission.

However, with the move to EVs and Agency and direct sales models, the landscape has changed significantly to that of 2018.

Finance & Insurance

In comparison to other markets such as the US. the Australian automotive industry is historically poor in Finance & Insurance (F&I) penetration, even before the ASIC intervention Deferred Sales Model (DSM). Given the changes in the market recently, via ASIC’s review in 2017, then ban on flex commissions in November 2018, the Finance Royal Commission and now the DSM, dealers need a F&I penetration rate of over 50 per cent to make up for lost commissions.

According to some industry reports, because of DSM, general insurance sales have fallen up to 90 per cent (ASIC’s add-on insurance crunch: Click here) leaving the lion’s share of recovering commissions up to the finance side of the business. This is where financiers in dealerships need to compete with the wider marketplace, as savvy consumers are shopping for the best finance deal prior to coming into the dealership.

Aftersales

Aftersales and managing the customer lifecycle will become more and more important as supply returns to pre-pandemic levels.

Currently, dealerships are heavily geared and focussed on front end operations as this is where the significant gross margin contribution is occurring.

Dealers have potentially forgotten that the aftersales – Service & Parts – are historically the main contributors to profitability in the dealership. Dealers should be reviewing their businesses now to identify any issues in customer retention and be implementing plans now. The longer there is no action, the more expensive the corrective behaviour becomes.

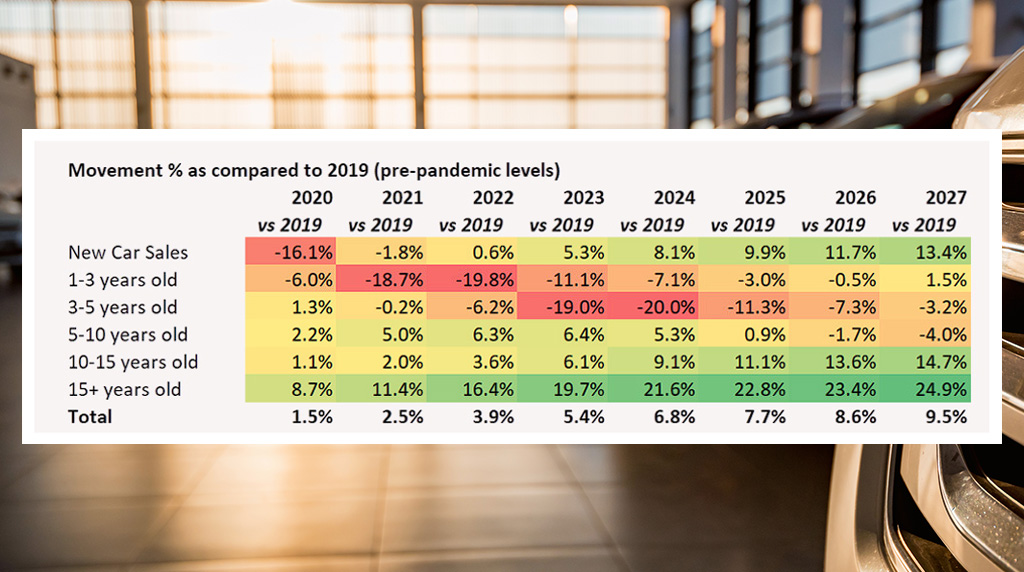

This is particularly prudent given the hole in the car parc that has occurred due to the sales that we missed out on due to supply shortages. It is even more important that retention rates increase at least 20-30 per cent to cover the significant reduction in the number of cars that have been sold and hence will not be coming through the back-end operations of a dealership.

Previous reports in this series

By Steve Bragg

Read More: Related articles

Read More: Related articles