EV MAKER Tesla has pulled its membership of the Federal Chamber of Automotive Industries (FCAI) in a heated letter which claims the chamber is misleading the public over future vehicle prices under the New Vehicle Efficiency Standards (NVES) and that some price predictions on Teslas put out by the chamber are potentially commercially damaging to the brand.

Tesla is a member of the board of directors of the FCAI. It says the scrapping of its membership will take place at the end of June.

The move by Tesla was immediately followed by Polestar which has also taken issue with the FCAI’s numbers and says the price estimates being dispensed by the chamber “do not represent the position of Polestar and may have irrevocably damaged consumer perception and trust in the proposed policy” (Read more: Polestar joins Tesla in leaving FCAI).

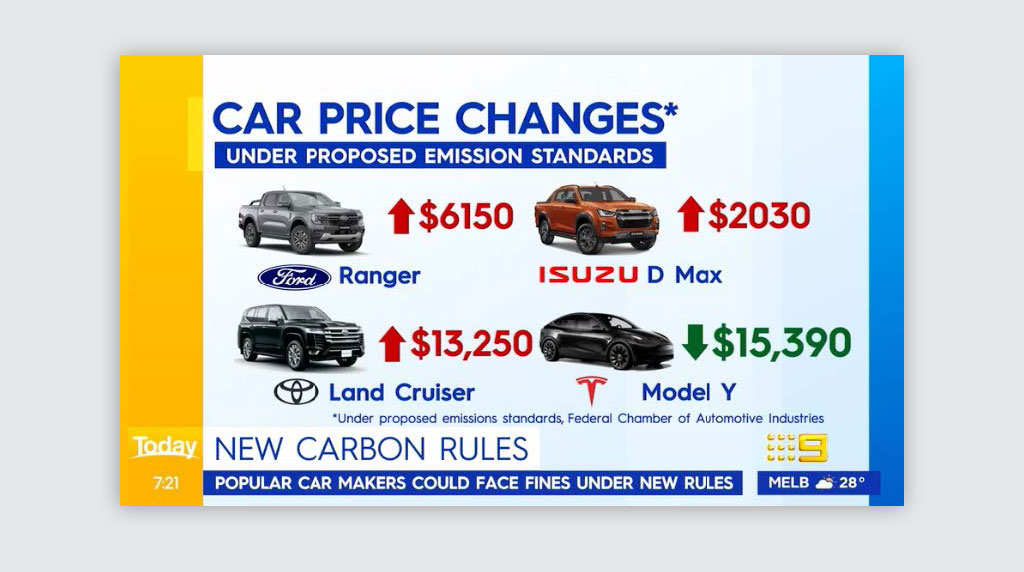

In the letter to the FCAI (full text below), Tesla took particular issue with the FCAI disseminating to the media reduced price estimates for its cars next year which it said were likely to stall sales as buyers waited for these lower prices to become available. Tesla said that price predictions attributed to FCAI, showed that “next year the Tesla Model 3 will be ‘$15,940’ and the Model Y ‘$15,390’ under proposed new vehicle efficiency standards”.

Tesla said that price predictions attributed to FCAI, showed that “next year the Tesla Model 3 will be ‘$15,940’ and the Model Y ‘$15,390’ under proposed new vehicle efficiency standards”.

“This is simply untrue,” the Tesla letter said.

“The FCAI purports to represent the automotive industry. Tesla is an FCAI member and is represented on the Board of Directors.

“An Australian consumer would reasonably conclude that the FCAI has knowledge and authority in claiming that Tesla vehicles will be discounted under NVES as claimed.

“These figures are falsehoods, produced without Tesla’s knowledge or approval.”

Yet these figures are falsehoods, produced without Tesla’s knowledge or approval.

The letter said that: “These misleading claims are likely to have commercial implications.

“A reasonable consumer would conclude that the FCAI is reflecting its members’ plans to make significant changes to vehicle prices next year under NVES; or that the NVES will directly fine or incentivise consumers by the claimed amounts.

“If consumers believe the FCAI’s false claims that electric vehicles are about to reduce in price by as much as 25 per cent next year, many will conclude they should avoid purchasing one now.

“Such impending price changes would also have immediate commercial implications for current EV owners including fleet operators for whom residual vehicle values are very material.

“Similarly, if consumers believe that the FCAI truly speaks for car companies when claiming that more polluting vehicles will increase by as much as $13,000 next year, they may rush to purchase the most inefficient vehicles in anticipation of soaring resale values.”

In the letter, Tesla requested that the FCAI:

- Issue timely public corrections to these false claims, including a clear acknowledgement that several of the claims the FCAI has made about vehicle price changes do not accurately reflect what car companies intend to do;

- Cease the public dissemination of misleading or deceptive information regarding the potential impact of NVES; and

- Cease any commentary and meetings in which the FCAI foreshadow or coordinate whether and how competitor companies will change prices or supply in response to NVES.

The Tesla letter outlined its concerns under three main headings accusing the FCAI of making:

- False claims about vehicle prices

- Cherry-picking the most polluting variants

- Misrepresenting how standards work

Referring to the suggestion by the FCAI that Tesla’s prices will fall dramatically by next year, Tesla said: “Even when a car company ends a year with net pollution debits, they can avoid penalties by purchasing credits from other manufacturers.

“The FCAI’s claims either ignore credit trading or falsely assume that regulatory credits would be traded at the penalty price.

“It would be irrational for a company to pay a competitor $100 per gram for regulatory credits rather than pay a $100 penalty to the government.

“That’s why it is impossible to imagine that Tesla could realise $15,940 in revenue from the sale of a Model 3 to pass on to customers as equivalent price discounts. While Tesla may generate 159.4 grams of regulatory credits per Model 3 sold in 2025, it absolutely is not the case that regulatory credits would simply translate into $15,940 price reductions for consumers.

“Other companies may not purchase credits at all, may defer purchasing credits for several years and are unlikely ever to purchase credits at the same price as penalties.

“Most importantly, the entire purpose of new vehicle efficiency standards is to decrease overall vehicle emissions. The more standards achieve this important purpose, the less regulatory credits will be worth.”

See full letter below

Thursday 7 March 2024

Tony Weber,

CEO

Federal Chamber of Automotive Industries

Level 1, 59 Wentworth Avenue KINGSTON ACT 2604

By email

Dear Mr Weber and FCAI Directors,

Tesla Motors Australia, Pty Ltd (Tesla) writes to raise serious concerns about false and misleading public comments by the Federal Chamber of Automotive Industries (FCAI) regarding claimed price impacts on Tesla and other vehicles of New Vehicle Efficiency Standards (NVES) proposed by the Australian Government.

Over the past three weeks, Tesla considers that the FCAI has repeatedly made claims that are demonstrably false. Tesla is concerned that the FCAI has engaged in behaviours that are likely to mislead or deceive Australian consumers. Tesla is also concerned that it is inappropriate for the FCAI to foreshadow or coordinate whether and how competitor brands implement price changes in response to environmental regulations such as the NVES. These concerns are set out in more detail below. Tesla has requested the Australian Competition and Consumer Commission consider these issues.

Tesla requests the FCAI:

- Issue timely public corrections to these false claims, including a clear acknowledgement that several of the claims the FCAI has made about vehicle price changes do not accurately reflect what car companies intend to do;

- Cease the public dissemination of misleading or deceptive information regarding the potential impact of NVES; and

- Cease any commentary and meetings in which the FCAI foreshadow or coordinate whether and how competitor companies will change prices or supply in response to NVES.

Considering these concerns, Tesla will cease to be members of the FCAI at the end of the 23/24 financial year. Until that time, Tesla will continue to report sales numbers through VFACTs, to ensure continuity of public reporting of vehicle trends including electric vehicle uptake.

1 – False claims about vehicle prices

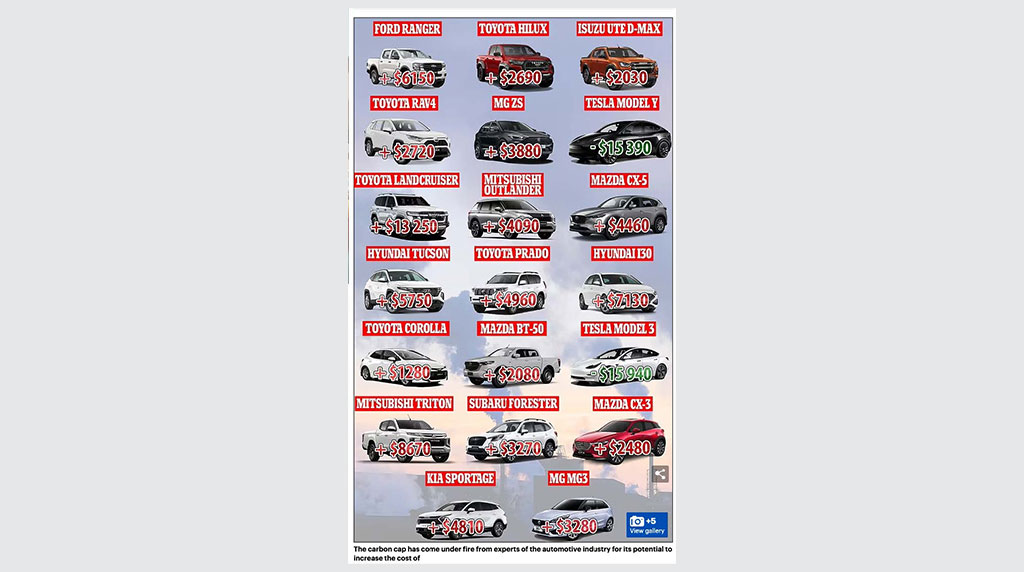

On 17 February 2024, several media outlets published print and television stories featuring claims by the FCAI about price changes to the 20 top-selling vehicle models under NVES.

For example, News.com.au published an article that featured claims made by the FCAI about the impact of the NVES on upfront vehicle prices and included a graphic (see Appendix 1) titled “How Australia’s top 20 cars will fare under proposed new emissions standards”. Similar graphics ran on the same date in the Daily Mail (Appendix 2) and then on Channel 9’s The Today Show (Appendix 3) where FCAI CEO Tony Weber claimed: “Next year if the vehicle you purchase doesn’t meet the standard as put out by the government, you have to pay a fine.” Clearly implied in the graphics, headlines, and the direct quotes from FCAI is the claim that these particular vehicle models would increase or decrease in price to consumers by the specific amounts claimed.

According to these graphics sourced from and attributed to FCAI, next year the Tesla Model 3 will be “$15,940” and the Model Y “$15,390” under proposed new vehicle efficiency standards.

This is simply untrue.

The FCAI purports to represent the automotive industry. Tesla is an FCAI member and is represented on the Board of Directors. An Australian consumer would reasonably conclude that the FCAI has knowledge and authority in claiming that Tesla vehicles will be discounted under NVES as claimed. Yet these figures are falsehoods, produced without Tesla’s knowledge or approval.

These misleading claims are likely to have commercial implications. A reasonable consumer would conclude that the FCAI is reflecting its members’ plans to make significant changes to vehicle prices next year under NVES; or that the NVES will directly fine or incentivise consumers by the claimed amounts.

If consumers believe the FCAI’s false claims that electric vehicles are about to reduce in price by as much as 25% next year, many will conclude they should avoid purchasing one now. Such impending price changes would also have immediate commercial implications for current EV owners including fleet operators for whom residual vehicle values are very material. Similarly, if consumers believe that the FCAI truly speaks for car companies when claiming that more polluting vehicles will increase by as much as $13,000 next year, they may rush to purchase the most inefficient vehicles in anticipation of soaring resale values.

2 – Cherry-picking the most polluting variants

It appears that the FCAI has misled consumers by claiming that entire models of vehicle will incur specific penalties that are passed on to consumers, when in fact the FCAI have selected the most polluting variant of that model.

For example, the FCAI has claimed that the Ford Ranger will increase in price by $6,150. The FCAI appear to have based their claim on the most polluting Ranger variant, the Raptor, which emits 262g CO2/km according to the Australian Government’s Green Vehicle Guide

(GVG)1. Several of the pictures of Ford Rangers run by media next to this claim appear not to be Raptor variants. The GVG lists 42 variants of the Ford Ranger for 2023 of which 20 are reported to have CO2/km of 199g/km or less; the most efficient is listed at 182g of CO2/km. Under Option B of NVES the 2025 category CO2 target for light commercial vehicles is 199g (although each variant’s specific CO2 target under NVES will depend on its mass).

Many of the models the FCAI has cited including The Ford Ranger, Toyota Hilux, and Isuzu D-Max have variants that appear to be under the proposed 2025 NVES CO2 targets for 2025. If so, these variants would receive credits and by the FCAI’s logic would be cheaper for consumers, not dearer.

3 – Misrepresenting how standards work

FCAI’s claims appear to be based on a simplistic and false calculation: where a vehicle (or a selectively chosen variant of the vehicle) is over or under its mass-adjusted CO2 target under proposed standards, the FCAI multiply this difference by $100 per gram of CO2, which is the proposed penalty price. The FCAI then claims this will be the price increase or decrease for consumers. This is not how the NVES works.

A – Car companies will pay no penalties at all if their average emissions comply with standards.

It is misleading to claim that all vehicles above the CO2 target will incur penalties. Individual vehicles do not accrue penalties, but rather accrue debits or credits. Car companies only face penalties if they have more debits than credits across all vehicle sales for a year.

Of the 20 top-selling vehicles in Australia that the FCAI has referred to, 11 are sold by companies that performed below their target for EPA standards in the USA. Although many of these companies still sold highly polluting vehicles in the USA, they balanced out their sales with more efficient vehicles and paid no penalties under EPA standards in 20222.

B – Car companies trade credits at below the penalty price.

Even when a car company ends a year with net pollution debits, they can avoid penalties by purchasing credits from other manufacturers.

The FCAI’s claims either ignore credit trading or falsely assume that regulatory credits would be traded at the penalty price.

It would be irrational for a company to pay a competitor $100 per gram for regulatory credits rather than pay a $100 penalty to the government.

That’s why it is impossible to imagine that Tesla could realise $15,940 in revenue from the sale of a Model 3 to pass on to customers as equivalent price discounts. While Tesla may generate 159.4 grams of regulatory credits per Model 3 sold in 2025, it absolutely is not the case that regulatory credits would simply translate into $15,940 price reductions for consumers. Other companies may not purchase credits at all, may defer purchasing credits for several years, and are unlikely ever to purchase credits at the same price as penalties.

Most importantly, the entire purpose of new vehicle efficiency standards is to decrease overall vehicle emissions. The more standards achieve this important purpose, the less regulatory credits will be worth.

1 Green Vehicle Guide, accessed 3 March 2024

2 2023 Automotive Trends Report , Environmental Protection Agency.

4: Tesla is uncomfortable with the FCAI indicating that carmakers will enact fixed price changes in response to emissions standards.

As an industry association, the FCAI should be careful to not facilitate coordination among competitor companies about how they change prices or supply in response to regulations.

Any impacts of NVES on vehicle prices – both up and down – are subject to complex competition and trade between competitors in both the vehicle market and the regulatory credit market. Companies have several options in responding to the NVES including adjusting product mix, adjusting volume, carrying debits and credits over several years, and negotiating trade of regulatory credits. When the FCAI makes blanket claims about how its members will change product prices, it risks facilitating or creating the impression of anti competitive behaviour. It is up to individual companies to set prices, and it is inappropriate for the FCAI to tell companies in private meetings or public commentary what any price changes will or should be, or to suggest that these price changes are fixed and uniform.

Appendix 1 – Graphic provided to News.com.au

Appendix 2 – Graphic in Daily Mail.

Appendix 3 – Graphic on Today Show

By John Mellor

Read More: Related articles

Read More: Related articles