AS THE Australian motor industry gears up for 2024 (after a record breaking 2023), dealerships are facing an array of challenges that demand strategic foresight and adaptability.

At Pitcher Partners we have been delving into the top 10 challenges that are shaping the landscape and here we explore how industry players can navigate through these tumultuous times.

Last week we covered the following (click here):

- Margin compression has returned, and unprepared dealerships will experience significant financial strain

- Strategic stock management will be back ‘en-vogue’

- Used cars valuations will decline further

- Cost structure re-evaluation

- Building your own brand loyalty (retention)

This week …

- Cybersecurity vulnerabilities:

Cyber-attacks are emerging as a major threat in 2024, recently Eagers Automotive had a cyber incident causing disruptions and requiring them to halt trading on the ASX. This was covered by GoAutoNews Premium (click here):

Dealerships are now high-value targets, we are urging all our clients to prioritise cybersecurity measures to safeguard sensitive information and maintain operational continuity. It’s not too late to get prepared, but it’s minutes to midnight.

- The Rise and Rise of Chinese-Built vehicles:

Chinese-built vehicles are poised to challenge their Japanese counterparts for market supremacy in terms of volume in 2024, marking a significant shift since they constituted only 3.3 per cent of the market in 2020.

Chinese-built cars made up nearly 1 in 6 new vehicles sold in CY23, totalling 193,433 (per VFACTS). This trend aligns with the growing popularity of electric vehicles (EVs), introducing a transformative dynamic to the industry.

The Australian market is changing at lightning speed. EVs now make up 7.2 per cent of all vehicles sold in CY23 or 87,217 units. The domestic Chinese market is already selling EVs at levels the western governments are forecasting for 2035.

But slowing local demand in China and overcapacity at their OEMs after years of state-directed growth means the Chinese manufacturers are looking to overseas markets for their product. Exports surged in 2023, as we have seen in Australia, and we expect this to continue.

With the Chinese built cars rising from 3.3 per cent in 2020 to 16.7 per cent in 2023, the trend is clear.

In EVs the domination of China is frightening. Chinese built EVs dominate the Australian market (remember that Teslas are built in China for the Australian market), and their manufacturers have a significant cost and battery technology advantage that they have only just started to tap into.

BYD will soon dominate the Australian market with cheaper options for customers that want to buy an EV.

- Electric vehicle revolution:

Considering the above, China’s cost advantage and proliferation of brands and product will only improve the affordability and variety of electric vehicles which will continue to drive their popularity.

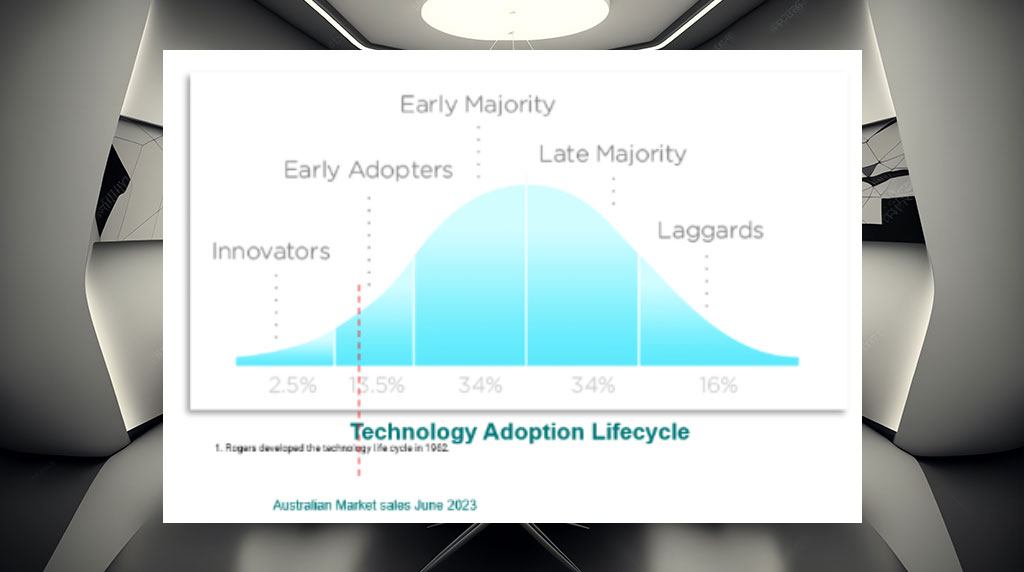

While Australia should expect to face a similar EV adoption plateau as the USA, the fact is that EVs are undeniably the future. Refer below the new technology adoption lifecycle that shows we are only at the beginning of the EV evolution. So there is a long way to go and a lot of kinks to work through to full adoption.

Linking the previous point on the rise of Chinese built vehicles. Chinese-built EVs, with a significant cost and battery technology advantage, will drive the overall volume of Chinese built vehicles sold in Australia to surpass their Japanese counterparts in the coming years.

More on China’s battery tech domination.

Batteries comprise approximately 40 per cent of the cost of an EV. Bemoaning that China’s success only comes from multi-decade government planned efforts is both true and academic at this point.

China’s advantages are intimidating. China controls two-thirds of the world’s capacity for processing lithium and they dominate every aspect of battery production. They produced 10 times the amount of battery EVs in 2023 as Germany.

Chinese brands have, at a minimum, between 20-25 per cent cost advantages in the production of batteries compared to their Japanese and Western OEM competition.

- Fuel and emissions standards:

The Australian government’s commitment to announcing a fuel emissions target by the end of 2023 has come and gone without an announcement. However, they have announced they are adopting Euro 6d by 2025 and we expect some announcement of a fuel and emissions standard in 2024.

If they adopt anything near the UK, Europe or the now repealed NZ models the importation and retail of many brands models to Australia could be uneconomical, requiring proactive adaptation and urgent industry attention. Getting it wrong could mean the end of many brands operations in Australia.

- Agency and direct-to-customer sales model adoption postponed further:

Following the sharp declines in sales for Mercedes-Benz and Honda, the adoption of agency sales models is likely to slow down further.

Sales experiences and pricing challenges present significant hurdles, dissuading other brands and new entrants to Australia from considering a switch from their current franchise distribution model.

The facts are stark as shown in the recently released December 2023 YTD VFACTs data.

Mercedes Benz sales have declined 2,486 units or 9.3 per cent in a market that increased by 12.5 per cent. That’s a relative market volume decline of 21.8 per cent and a market share decline of 19.4 per cent from CY22.

Honda didn’t fare much better. It declined 3.4 per cent from CY22 in terms of volume (relative market volume decline of 15.9 per cent) and a decline of 14.1 per cent in terms of market share. This is on top of the sales declines experienced in CY22 which were much sharper for Honda (dropping 19.1 per cent from CY21).

Bonus takeaways:

Facility optimisation and future planning. Dealerships need to reassess their facilities as the reality of EVs and their lack of regular service intervals starts to bite. Dealers will need to right-size their property to align with the evolving business model that will see fewer customers returning to the dealership for regular interval services.

Anticipating these challenges in 2024, it is crucial to plan for the next decade and scrutinise any OEM demands for corporate identity upgrades and property footprints that don’t stack up economically.

Dealers need to focus on property cost-efficiency per unit and per square metre by measuring rent per unit and rent per square metre in the showroom and forecourt.

Fleets will dominate volumes in 2024. As we experienced in the second half of CY23, dealers need to show some love to their fleet department. With the retail customer facing constrained budgets, increasing prices and difficulty with finance, the fleet buyers will be looking to replenish their car fleet and it could be the saviour to what could be a sharp drop in volumes.

Disruptive markets present massive opportunities. Dealer groups that proactively navigate these challenges and invest in building their brand and resilience will reap the benefits once the market stabilises. Despite the current market turbulence and evolving drivetrain disruptions, the transition presents opportunities for those prepared to face the economic headwinds and emerge stronger in a steady-state market.

Read more:

Part 1 click here: 2024 demands dealership strategic foresight and adaptability

Steven Bragg is the lead partner of the motor industry services group at Pitcher Partners Sydney.

By Steven Bragg

Read More: Related articles

Read More: Related articles