The research, by Steve Bragg and Aidan Cousin of Pitcher Partners Sydney, said that the lower sales of new cars would cause a ‘black hole’ in on-going used car sales opportunities and service opportunities that would flow through car retailers for the next five years.

The hole created by the lower sales on new cars since 2019 will be as much as 500,000 vehicles which dealers will not have the opportunity to buy or sell or service.

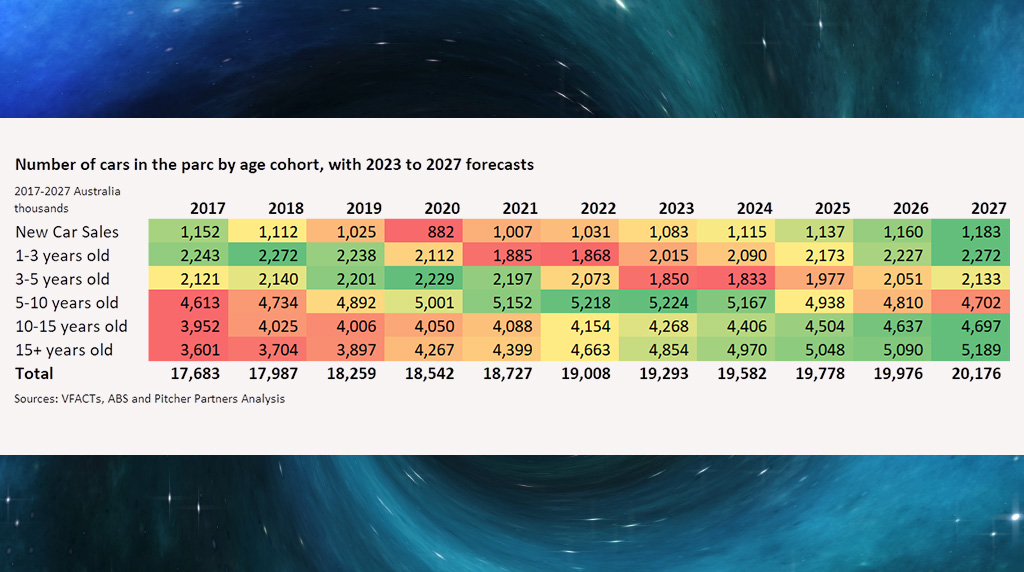

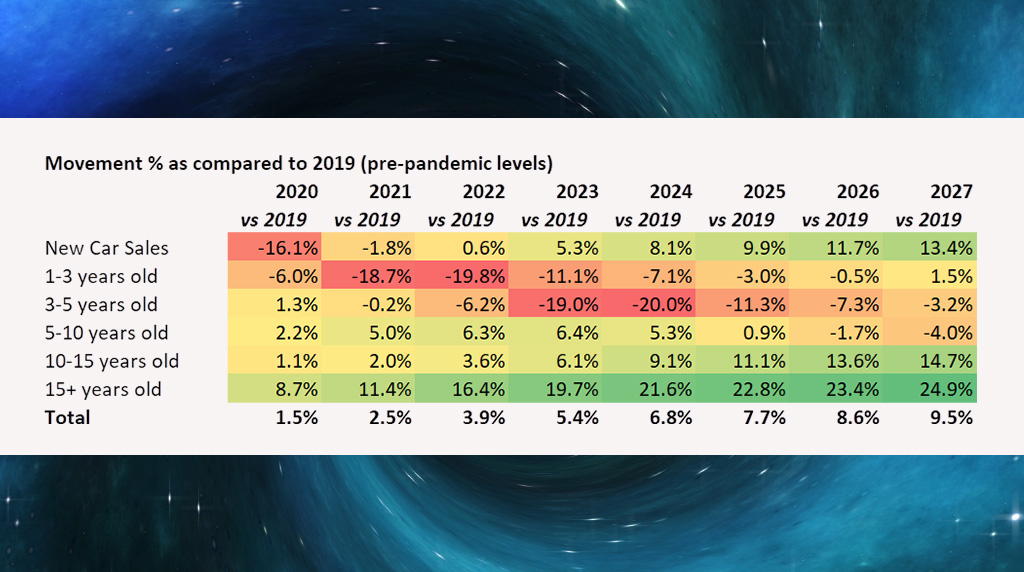

The report said: “It will have a lasting impact, with fewer cars flowing through the parc causing supply constraints at different age bands.” (See tables below).

“Historically the one- to five-year-old used car market has been the franchise dealers’ sweet spot.

“Between 2022 and 2024 there is going to be up to a fifth of the market missing because of COVID-19.”

The report said there would be a significant squeeze on three- to five-year supply coming in 2023 and 2024 which will lead to material P&L pressure that will last until 2027.

“It is not until 2027 that the one- to three-year-old used car parc returns to pre-pandemic volumes, and that is assuming significant increases in new car sales, supply chain availability and demand remains consistent despite current cost of living increases.

“Over the same time frame, the average age of passenger vehicles is expected to increase by one year (from 9.9 years to 11.1 years) to compensate based on our analysis,” the Pitcher Partners report said.

“For some time, we have seen the impact of supply chain constraints and COVID-19 on new and used car sales, increased used car values and increased sales price for new car with long wait times for new vehicle deliveries. The impact is long lasting and will continue to affect the Australian car parc in a significant way for the foreseeable future,” it said.

Impacts & challenges for dealers

Pitcher Partners said that dealers needed to develop strategies to retain the customers with vehicles in the one- to five-year-old range throughout their lifecycle.

It said that the service department would be a key mechanism for retention of customers during this period.

The report said dealers should identify customers that have a full-service history at the dealership and a trade-in the dealer can market as a certified used car. Dealers know the history of the car, the ins and outs and this brings added comfort to the buyer.

It said dealers should be structuring warranties and service plans to ensure new customers pass through to service.

Dealers should also consider:

- Now is the time to hold older used vehicles and be open to parallel imports to keep the same levels of used stock in the sales yard

- How to optimise the used car space to avoid holding undesirable vehicles and increase the turnover of stock

- How to improve service experience to compete against independents for servicing of the one- to five-year-old-plus vehicles

Dealers should also consider:

- When do dealers look to hold ‘older vehicles’ or be open to parallel imports to keep the same levels of stock in used cars

- How to optimise the used car space to avoid holding undesirable vehicles and increase the turnover of stock

- How to improve service experience to compete against independents for servicing of the one- to five-year-old-plus vehicles

Analysis undertaken

- Pitcher Partners analysed VFACTs new car sales data from 1992 to 2022, applying historical attrition rates (vehicles that exit the car parc for various reasons) to get a clear picture of the car parc by age cohort

- The stratified age cohort was crossed referenced to ABS data on the Australian car parc to verify the analysis

- The analysis excludes heavy commercial and motorcycles…effectively focusing on passenger and LD commercial vehicles

- The forecasted new vehicle sales from 2023 to 2027 assumes the following growth rates (YoY): 2023 – five per cent increase (due to supply returning). 2024 – three per cent increase (remaining supply return), 2025 to 2027 – two per cent increase (in line with historical averages).

The analysis does not include the impact of EVs as it would muddy the waters and merits its own analysis.

By John Mellor

Read More: Related articles

Read More: Related articles